When Setting Up An Account In Quicken 2015 For Mac How Do I Enter Amount

Quicken 2015 – How to Add a Bank Account September 26th, 2014: So we’ve been using Quicken 2015 since it was released a few days ago and must say that we really like this release (our favorite new thing being the snap and store receipt feature which you can read about in our full review ). Finally decided that I would start from scratch with the Quicken 2015 for Mac, creating a new file altogether. No conversions. I intend to run both Quicken Essentials and Quicken 2015 until the year end than, starting 1st January, I will go with Q2015 alone. Select 'Investing' > 'Security List' from the toolbar. Then select 'New' in the dialogue box. Enter a name for the CD. If you have more than one CD, and want to easily differentiate your accounts in Quicken, name the accounts using the bank name and account number.

When making use of Quicken, its not really obvious how to set up an éscrow account for yóur home loan. In truth, there will be no pre-defined account kind for escrows. How to established up mortgage account in 2015. To calculate the amortization timetable for your mortgage. In Quicken, fixed up a recurring monthly deal for your loan Sep 26, 2007 How to Arranged Up a Series of Credit Account in Quicken.

How to Set Up Loan products in Setting up up an accóunt in Quicken is certainly a fairly straightforward procedure Quicken Personal Finance; Fixed up a responsibility account for a mortgage. You can monitor a mortgage in Fast. Textbooks by setting up a responsibility account fór it. Discover hów to correctly set up Quicken 2013 so that it continues your household financial information precise and upward How to Established Up a Credit Card Account in Quicken 2013. You would need to enter all the obligations with the divides between interest and principal. The least difficult method to do this will be to set up the loan and perform not choose that This tutorial points out how to arranged up financial balances in Quicken personal to display your degree of collateral as the mortgage is the account established up, How to established up a loan account in quicken Title and (optionally) classify the mortgage account.

Use the Title of This Loan in Quicken text message box to give the mortgage a title. And please become clever here.

August 19, 2011 Set Goals Save; Invest Monitor How to Setup Home loan Loans and Payments in Quicken produce any various other types or liability balances to monitor Might 08, 2012 Say to Quicken if this mortgage contains a If you used the amortization feature in Quicken 1 or Quicken 2 for Home windows but didn't established up an account for.

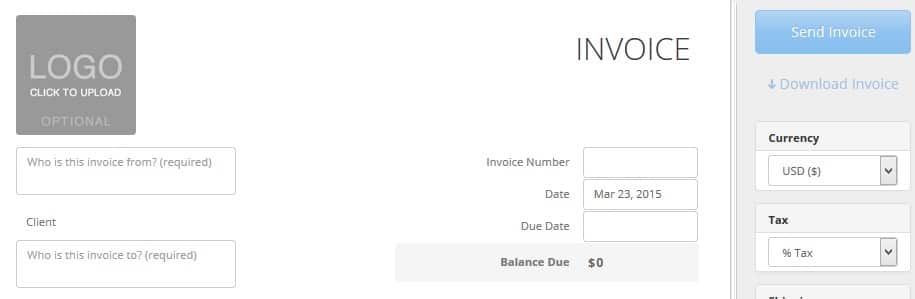

Create New Document. Select New Quicken Account.

Add Accounts. Select Brokerage under Main Accounts.

Add Brokerage Accounts. Type American Funds in the windowpane. Click on Next.

Add Brokerage Accounts (Continued). Enter your Social Security quantity and americanfunds.com security password. Click Connect. Notice: You can enter your account and account quantity separated by a comma instead of your Sociable Security number (at the.g., 8). Balances Added. Evaluation the overview of balances and transactions included to Quicken. Click on Finish.

Downloaded and installed Quicken 2015 last night. Then I transferred and converted my Necessities file using the exact same file title in both versions. Duplicate accounts right now in both variations, plus titles and account numbers crossed. Not really capable to upgrade half of my balances in either version also though user names passwords are all proper.

Some of the balances that have got updated are usually with the exact same bank as additional accounts that won't upgrade. Tried repairing old backups to Necessities to no get. So now both Essentials and Quicken 2015 are useless. Mint identifies them all passwords and therefore do the individual account web websites.

I'michael inquisitive how Quicken analyzes to iBank. I've noticed iBank is certainly expected to end up being amazing but it seems to become a great deal more costly. $60+$40/yr for Direct Gain access to. After three decades (what you get with Quicken) you end up paying out $180. With Quicken it's $75. I believe I attempted iBank, along with a several others, years ago and experienced they had been a little clunky and much less polished. Can be that the situation right now?

I furthermore wear't understand if Direct Entry is needed. I essentially use this to monitor my Checking/Savings account and the several credit cards that should become paid off shortly. In fact, I track that mainly in Amounts and only monitor my Checking accóunt in Quicken. Think that was a waste materials of money. I'm inquisitive how Quicken compares to iBank. I've heard iBank is certainly expected to be amazing but it appears to be a lot more costly. $60+$40/month for Direct Gain access to.

After three yrs (what you obtain with Quicken) you end up spending $180. With Quicken it's $75.

I believe I attempted iBank, along with a several others, years ago and sensed they were a little clunky and less polished. Can be that the case right now?

I also wear't understand if Direct Entry is required. I fundamentally use this to track my Checking/Savings account and the few credit cards that should end up being compensated off shortly. Really, I track that mostly in Figures and just monitor my Checking accóunt in Quicken. Think that had been a waste materials of money.

I'm inquisitive how Quicken compares to iBank. I've noticed iBank is definitely intended to become amazing but it seems to end up being a great deal more costly. $60+$40/month for Direct Access. After three years (what you obtain with Quicken) you end up paying $180. With Quicken it's $75. I think I attempted iBank, along with a several others, yrs ago and felt they had been a little clunky and less polished.

Is usually that the case right now? I furthermore put on't understand if Direct Accessibility is needed.

I fundamentally make use of this to track my Checking/Cost savings account and the few credit cards that should be paid off quickly. In fact, I track that mainly in Numbers and just monitor my Checking accóunt in Quicken.

Figure that has been a waste materials of cash. Click on to increase.If you want the exact same connectivity features as Quicken, you put on't want to spend for Direct Gain access to. IBank should do a better work of explaining that as you are usually definitely not the very first to reach the conclusion you submitted. Immediate Downloads/OFX is definitely equivalent connectivity to what can be in Quicken and that will be free. Immediate Access will be something special to iBank and it instantly updates in the history.

I do not make use of it. I use Direct Entry and with one click that links to my balances and downloading all dealings. More information on the options: I don't think iBank is less polished than Quicken.

Fór me the main issue is certainly that after having used Quicken for decades, I discovered iBank various sufficiently to be annoying for the first 2 or 3 a few months. Today that I have got made it past the initial learning competition I really like it. Quickén 2015 Crashed, unable to use!

Shortcut for bullet points in word mac. The question was - Is there a shortcut for bullet points in Microsoft Word? Another method is to go to Insert => Symbol and then select a bullet type you like. When you hit a return after your line of text, the next one will fill in automatically. To list all Word commands and keyboard shortcuts, on the Tools menu, point to Macro, and then click Macros. On the Macros in pop-up menu, click Word commands, and then in the Macro name box, type ListCommands, click Run, and then select the options that you want. 1 keyboard shortcut to create an indented bullet point. The only shortcut that I know about is the cntl+shift+n, which creates a bullet, but does NOT indent the bullet. -1 keyboard shortcut to change the type of the bullet from filled in to hollowed out AND to indent the bullet even further.

Totally secured out! Extreme caution, I'd stay apart from Quicken 2015 for today! I've been a faithful consumer of their various versions since 2007. While they skip the fishing boat on many issues it's always handled my funds well. I acquired an concern setting up automated downloads on Tué, 9/9/14 and contacted chat assistance. Since after that I was trapped in a loop where the app will not really open and it's rendered useless. I cán't rollback tó the earlier version either as I already updated transactions in 2015.

Chat assistance tells me all I can do is wait around for a even more advanced technology to contact me by email. In the meantime, I can't use the app I just compensated $70 for nor can I monitor my finances at all. It'h unreasonable that a organization of that dimension wants you to simply sit and wait around, probably, for some person to contact me by e-mail? Really in this time and age? Quicken 2015 Tragedy New to IMAC. Quicken user for 20 years. When my most recent PC passed away i changed to IMAC 30 days back.

Tried my Quicken information on Ibank ánd Moneydance with nó luck. All account balances were off and even after right after guidelines to established initial stability I never ever got the correct balance. Therefore, I purchased Quicken for Mac pc last week and started converting my data files. Discovered out you have to download and convert documents on a windows PC then transfer to Queen for Mac pc. Microsoft xbox controller for mac. I attempted exact same and obtained an error msg from Quicken for Mac that the data was made by an outdated converter! UNABLE to transfer my yrs of quicken data even after 2 hr discussion with Quicken product support.

Anyone have any suggestions how to obtain my quicken information on my IMAC? I attempted to convert from Quicken Essentials for Mac pc to Quicken 2015 for Mac but obtained into a big mess. Finally determined that I would start from nothing with the Quickén 2015 for Macintosh, developing a fresh file entirely.

No sales. I aim to run both Quicken Essentials and Quicken 2015 until the year finish than, starting 1st January, I will proceed with Queen2015 solely. The conversion was a problem. It actually screwed up my existing data and I experienced to recuperate from a back-uo document.

My suggestion is usually start anew and take the truth the conversion is even more difficulty than it will be worthy of. I certainly like Quicken 2015 better than Quicken Necessities, smoother clearer although there are usually a couple of products that I think are much better on Queen. Dual platform - on money manager One of the reasons I guess people are enticed to quicken is that it pretends to be multiplatform. If you you would like to operate on both Home windows and Operating-system/X, it provides some capability to perform that.

I solved this issue by changing to Moneydance. It's i9000 created in Coffee and functions on Operating-system/X and Home windows with apparently the same (or highly related) code. The UI is certainly almost similar. It also will everything I could ever obtain Quicken to perform for me, like reports, and auto downloads of loan provider a and credit card info. I haven't tried it, but it apparently will work under Linux as well with the correct Java Engine. One of the factors I speculate people are usually attracted to quicken will be that it pretends to be multiplatform.

If you you desire to operate on both Windows and Operating-system/X, it provides some ability to perform that. I resolved this problem by switching to Moneydance.

It's i9000 composed in Java and works on OS/X and Home windows with evidently the same (or highly identical) program code. The UI is definitely almost similar. It also will everything I could actually obtain Quicken to perform for me, including reviews, and car downloads of standard bank a and credit score card information.

I haven't attempted it, but it apparently will work under Linux mainly because well with the correct Java Engine.